Financial Modeling

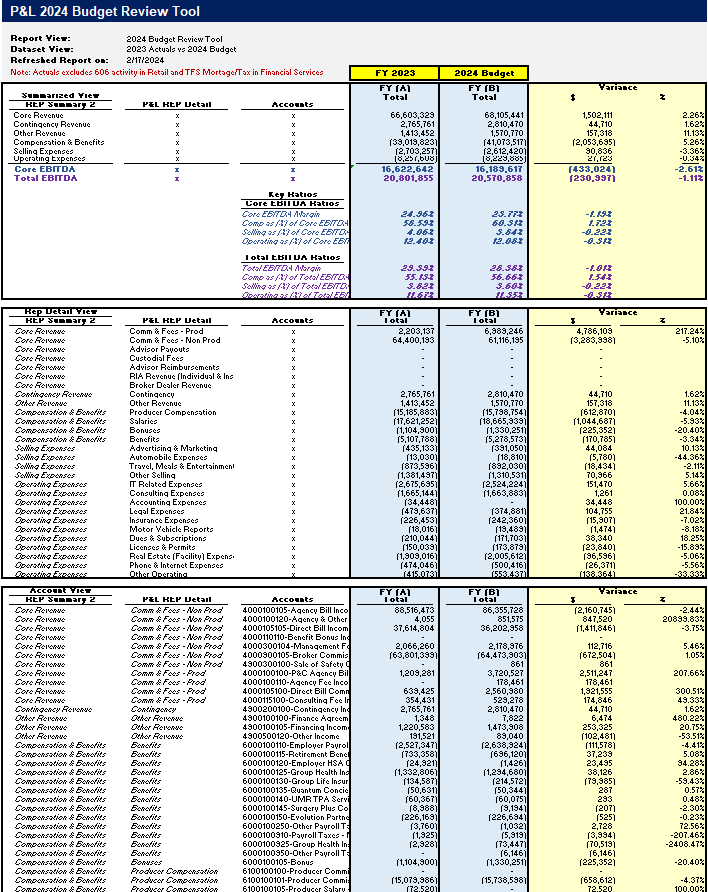

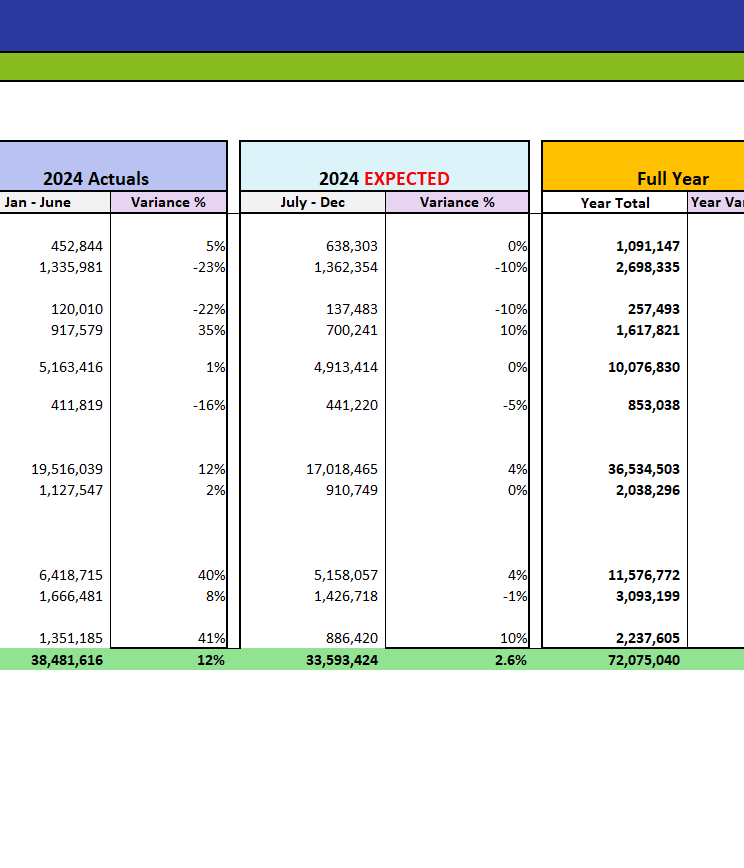

My methodology involves meticulous data validation, thorough analysis, and clear reporting, which ensures that my financial models are not only reliable but also actionable. This approach provides a solid foundation for making informed decisions, ultimately driving better financial outcomes for my projects and stakeholders.

These reports were entirely designed and created by me.

Budgets

Budgeting requires the strategic development of detailed financial plans to drive informed decision-making and ensure organizational alignment with financial goals.

Forecasts

Forecasting involves projecting future financial performance to guide strategic planning and anticipate business needs.

Variances

Variance analysis entails comparing actual financial results to forecasts and budgets to identify discrepancies and drive corrective actions.

Statements

3-Statement modeling integrates the income statement, balance sheet, and cash flow statement to provide a comprehensive view of financial performance and projections.